in favor of Hong Kong due to data security concerns. last week in a Didi investigation, the Financial Times reported on Thursday.īeijing allegedly forced podcast platform Ximalaya to halt plans to list the U.S. Some 16 companies, including Alibaba-supported Chinese media and data cloud service platform Qiniu, home care services company Daojia and ForU Worldwide, a digital freight transportation company, are looking to raise more than $ 4 billion, said people familiar with the transactions.Ĭhinese fitness app Keep, backed by Japan’s SoftBank and China’s Tencent, halted plans to file for an IPO in the U.S. This marks the fastest start in a year recorded by the data provider and compares to six listings that amassed $ 2.8 billion in the same period last year.Īnalysts and bankers now expect US IPOs of mainland companies to plummet, somehow in the short term. this year, collecting a total of $ 12.6 billion, according to Dealogic.

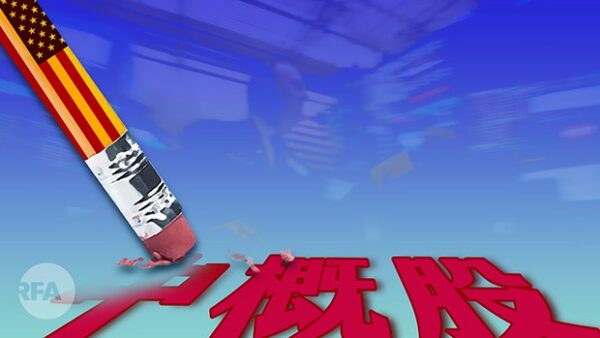

Thirty -six Chinese companies have held IPOs in the U.S. The company, which provides cancer-focused health care services by relying on big data and artificial intelligence, plans to sell 10.8 million shares worth between $ 17.50 and $ 19.50 each. Uncertainty exists on how quickly “legislative or administrative bodies that make regulation will respond and what existing or new laws or regulations or detailed implementation and interpretation will be changed or promulgated,” it said. On Wednesday, it updated the sale prospectus, anticipating risks from Beijing’s new directive on overseas IPOs. LinkdDoc, founded in 2014, filed for an IPO last month. The S & P500 Index rose 0.9% in the same time frame. Gathering regulatory adjustments lead investors to avoid Chinese stocks in the US The Nasdaq Golden Dragon China Index, which tracks 98 Chinese companies listed in the US, has fallen 7.9% since the first salvo of the cyberspace agency. Chinese authorities also announced on Tuesday that rules for overseas listings would be changed and regulatory oversight on companies trading in overseas markets would be increased.

DIDI KEEP XIMALAYA LINKDOC IPOTIMES FULL

market debut, which raised $ 4.4 billion in one of China’s largest corporate IPOs in years, was shaken by Beijing’s intervention.Ĭhina’s cyberspace agency has announced an investigation into Didi’s customer data handling and banned it from signing up new customers, sending its shares and wiping billions of dollars from its analysis just a few days after its listing.īeijing later expanded its investigation to two other US -listed companies – logistics company Full Truck Alliance and online recruiter Kanzhun. LinkDoc’s move comes after Chinese ride operator Didi Global’s U.S. Linkdoc, backed by Alibaba Health Information, caused the price on the deal today, which determines how much money will be available. However, market volatility, regulatory uncertainty and fear of resentment by Chinese regulators pushed the company to cancel the offer, one of the people said. The company plans to raise up to $ 210 million on the tech-heavy nasdaq exchange and closed its books on the deal on Wednesday after apparently strong demand. at the last minute, said two people familiar with the transaction, which became the first casualty in Beijing’s clamping of the lists in another country. HONG KONG-Chinese medical data group LinkDoc Technology stopped initial public offerings in the U.S.

0 kommentar(er)

0 kommentar(er)